- cross-posted to:

- technology@lemmy.world

- cross-posted to:

- technology@lemmy.world

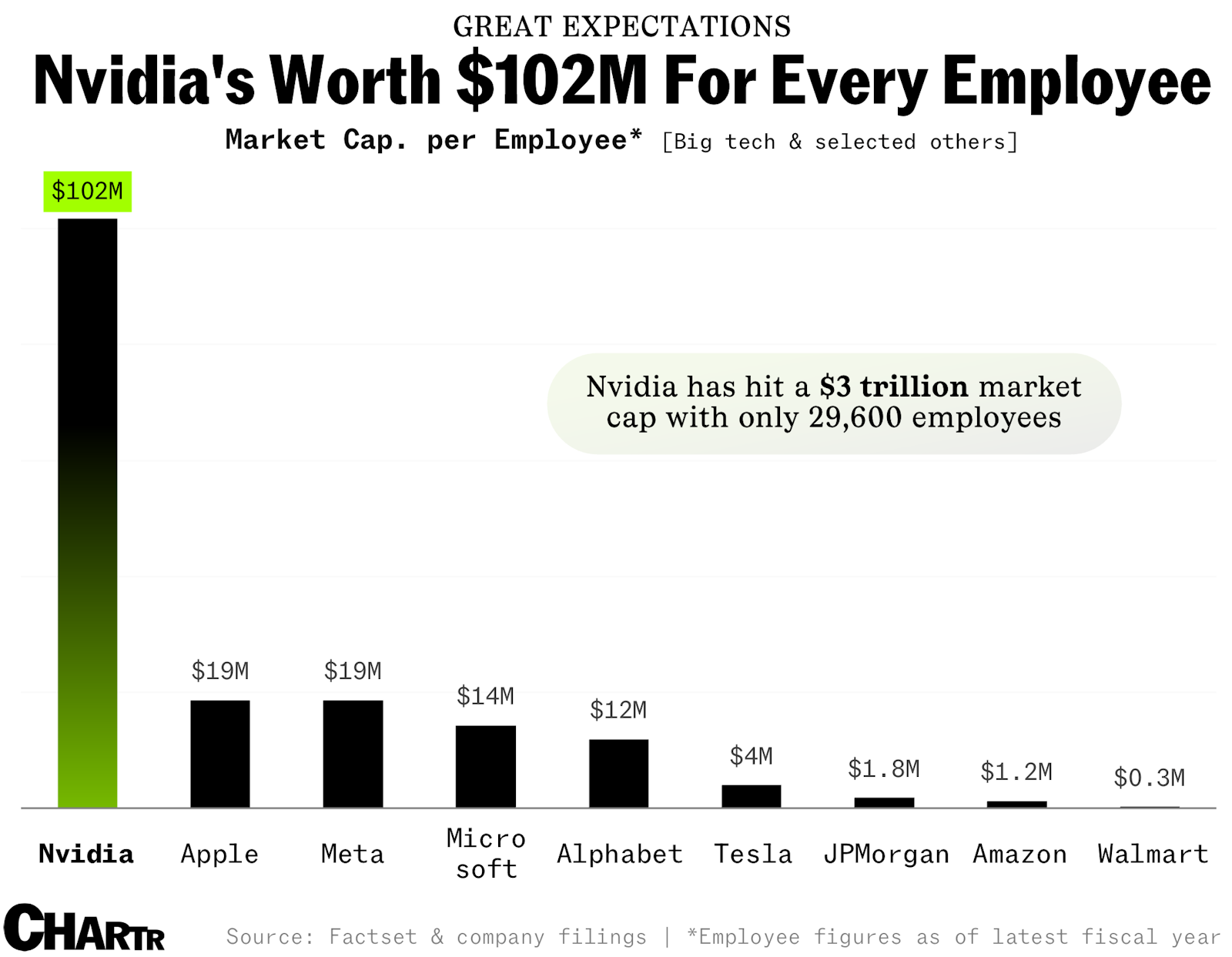

"…For Nvidia, after this latest run-up took it north of the $3T milestone, the company is being valued at more than $100M for each of its 29,600 employees (per its filing that counted up to the end of Jan 2024).

That’s more than 5x any of its big tech peers, and hundreds of times higher than more labor-intensive companies like Walmart and Amazon. It is worth noting that Nvidia has very likely done some hiring since the end of January — I think the company might be in growth mode — but even if the HR department has been working non-stop, Nvidia will still be a major outlier on this simple measure.

We are running out of ways to describe Nvidia’s recent run… but a nine-figure valuation per employee is a new one."

-

“Are the employees gonna see a cent of this?”

-

“Fuck, no!”

Well, they technically will see SOME cents of this because I’m pretty sure Nvidia gives employees stocks too.

But yeah, I also posted this because it’s a clear illustration of how most salaries will never reflect the value your labour brings to an organization.

Or more accurately, it’s a clear illustration of how overvalued they are right now.

But as the saying goes, the market can remain irrational longer than you can remain solvent.

I don’t think many people would claim overall valuation has much of anything to do with the value labor brings to an organization.

In this case I think all it indicates is just how much the company’s stock price is driven by speculation about possible demand for generative AI, and even then I’m not sure that current price per share times number of shares divided by number of employees is a clear indication of that.

I don’t think many people would claim overall valuation has much of anything to do with the value labor brings to an organization.

Apologies, can you clarify what exactly you mean by this? Because when I say their labour is not being valued, I do extend that to the Wall Street orgs that are doing the evaluations. They look at the “product” on offer, not the people actually working and developing it.

Are you saying because stock prices aren’t steady, we can’t correlate that to salaries?

I’m saying that while a companies market capitalization is a real number that can tell you things about a company, it is not like anyone involved has a three trillion actual dollars. The company doesn’t see any of that money directly unless they directly issue more stock which would devalue the current stock, though there are some other ways for a company to use it to their advantage. Investors might be able to get a small percentage of that by selling, but only because someone else bought in with an equal amount of money, and a large sell will drive down the price.

More to the point, the evaluations people are doing with Nvidia don’t have much to do with what the company actually produces and puts out into the world today, but the assumption that it can turn its current leadership position in AI accelerator chip designs into growing massively in size in the future when every company needs a large data center or two to train their own individual LLM’s.

A individual stocks price is driven primarily by what people think that individual stock certificate can be sold for in the future, and effected by things like how many people are trying to sell, adding all of those certificates up at current market price doesn’t actually give anyone involved much information, nor does it reflect the actual quality, quantity, material, or labor taken to make things, in this case branded computer chip blueprints, that a company puts out into the world.

Now there are a lot of competing theories of ways to try and measure labor’s value, but my work being only as valuable as the speculative amount my organization as a whole might be theoretically sold for as a whole in the future if no one tries to undercut anyone else isn’t one of the more popular ones.

The company’s valuation in a public company reflects the price that people pay for shares, so it shows the value of the company on the open market. The employees created this value, so it does indicate how much they each created quite accurately. And you would think that they’d at least get a representative percentage of that at least. I mean if you paint a painting and someone pays $1m for it, you get $1m gross. You make the software and IP that’s sold for $100m and you only get $100k a year, that’s kinda wack.

Firstly it shows the value of individual shares multiplied by the number of shares, not the company as a whole. Secondly, in this case Nvidia’s share price is based on what the company may be able to expand to do in the future, not what it currently does. Thirdly, where would this repersentive percentage come from? If it’s, issueing new stock to employees, A Nvida already does that a lot, B, creating new stock is not practically reliant on overall market cap so why is it relevant, and C, would employees also be punished for destroying the valuation if it turns out that every company doesn’t actually need a data center full of several thousand AI accelerators scraping the internet to make unique chat bots and Nvida’s market cap falls back down to what it would be based on how much money the company actually makes?

Again, Nvida primarily makes chip designs for outsourced fabrication, not market cap, that three trillion isn’t like revenue for Nvidia. In your painting example, market cap would be like if two unrelated billionaires bet 10 billion on whether or not that painter would be successful in selling a hundred different 1m paintings in the next six months, the painter might have an easier time say getting a loan for new supplies from a bank if they can point to the billionaire betting so much on them, but you know it’s not like the painter was actually paid that 10 billion that makes up the bet, right? So it’s kind of weird to say that the painter’s work as a whole is definitely worth that 10 billion bet.

The share price literally wouldn’t be what it was if people weren’t literally buying pieces of the company at that price. So it’s very literally saying what the company is worth on the open market. Even with all your obfuscation, that’s still the case.

With options trading, a lot of stock movement is reflective of speculation rather than true value.

Stock movement is always speculative with or without options. The difference that derivatives makes is the ability to price in speculative value at some point in the future as well. The price of a share is reflective of what traders think a company is worth today; but an option is a reflection of what traders think the shares will be worth at some point in the future, which people can then look at and use to re-adjust their estimation of what they think the underlying share price is worth today. It’s a recursive feedback loop that (theoretically) results in share prices closer approximating a true value. A sort of predictive smoothing function.

I’ll just leave this here.

https://www.businessinsider.com/nvidia-employees-rich-happy-problem-insiders-say-2023-12

That is the most… American thing I read in months. Workers complaining about half decent work conditions. As a European, being harder to get hired than to get fired was always a given to me, and I believe that’s a good thing.

That’s Business Insider being Business Insider, yeah.

I’m super confused by this verbiage. If it’s harder for a worker to get hired than fired, doesn’t that mean that it’s relatively easier to get fired? Which is nit how it should be right?

Based on the article context, shouldn’t the worker quoted in the article be saying “It’s very hard to get hired here, and getting fired is even fucking harder!”?

Anyway I agree that it should not be easy for a company to fire workers. I think that knowing this, companies should try to ensure they’re onboarding quality workers in the first place, which would probably involve a difficult hiring process.

My read on the article isn’t that workers are complaining about “half decent work conditions”, but that workers are complaining about completely checked out coworkers. If you’re a new, junior level worker and both your manager and your Intermediate and Senior level coworkers have completely checked out, you’re probably not getting the performance feedback, mentorship, or over the shoulder exposure to techniques and procedures that are invaluable at that stage in your career.

I’m definitely reading between the lines, but I’m seeing an article where less tenured employees are complaining about that culture shift, and BI is putting their “happy, well-compensated employees bad” corporate bootlicker spin on it.

Brilliant, thanks for this!

I said in a comment on mastodon that I don’t think the batch of newer employees hired at Nvidia are going to have anywhere near the same compensation as the current employees do, and this kind of helps support my suspicions…

Which could lead to a morale problem in the company too (speaking from experience)

I just responded to someone else in another comment chain, but I agree. As I said there, the more tenured employees checking out can really block anyone new from gaining the long-term institutional knowledge they need to be successful, which either leads to high new worker turnover or an implosion when the last of the long term “old breed” retire.

Thanks, I should have done that and forgot. I was typing up what I remembered from the article, then realized I’d prolly fuck up a significant portion of the relevant facts so I just deleted it all and searched for the article.

I have noticed that archive.is (and another tld I don’t remember right now, .ph?) links don’t want to load on my internal network that uses a pihole for dns and drops anything else dns related going out on the wan port of the router. Probably need to look in to that bc it’s getting annoying.

-

In Nvidia’s case that’s actually true for long tenured employees - assuming they cash out before the bubble bursts.

I can’t imagine most Nvidia employees don’t make enough to become millionaires within like 5-10 years if they aren’t already. Their entry-level software engineering positions have a base pay of $147K and total compensation of $180K. The lowest paying level of senior engineers gets more like $300K… Even the ones who leave before then are highly likely to get a job with comparable pay or benefits considering they have Nvidia on their resumé.

Now, tens-of-millions-aires, I don’t think most employees get there.

kagis

They probably aren’t hurting.

Aside from any other forms of stock-based compensation or bonuses – which they probably aren’t gonna publish – looks like they’ve got an employee stock purchase plan.

https://www.nvidia.com/en-us/benefits/money/espp/

Enroll in our current ESPP offering during the month you’re hired or during an official enrollment period, which occurs in February or August. Elect to contribute from 1-15 percent of your salary through payroll deductions.

Your offering price for NVIDIA ESPP gets set the first trading day after the month you’ve enrolled, and it remains the look-back price for up to 24 months.

During these two years, there will be four purchase periods. Your contributions over each period will purchase our shares at a 15 percent discount.

The company’s worth something like 200 times what it was in 2015.

https://www.levels.fyi/companies/nvidia/salaries/software-engineer

Software Engineer compensation in United States at Nvidia ranges from $178K per year for IC1 to $542K per year for IC6.

If someone’s been maxing their ESPP out, just from that alone, they’re probably doing pretty well. You convert 15% of your salary into stock, and that 15% of your income from 2015 alone is worth ten years of income down the road, over a million.

Layoffs imminent

The great thing about the stock market compared to other investments like crypto is that stocks are based on the inherent value of the business they represent. Stocks are based on financial fundamentals. You can believe in those investments because they are based on something real and not simply rampant speculation. For example.

Tesla. Worth more than most of the rest of the car market combined because… reasons?

Paypal. Lost 80% of its value starting in July 2021 over a year and never recovered because of terrible problems? Huge losses? Nope, because it “only” grew at 8-9%.

2008 US housing rated as “AAA” investment i.e. “good as cash” based on actual trash.

because they are based on something real and not simply rampant speculation.

/s

I mean… It would be true if there were no derivatives. When you start betting money on whether the line goes up or down, the stock price cases being reflective of the stock’s value.

In my understanding, derivatives amplify the problems and risks. Underlying that are the money people who push on these systems as hard as they can and exploit every angle. Along the lines of pushing the boundaries, the practice of brokers “loaning” shares seems like another place that’s bound to cause issues at its limits. I really wish the govt would step in and impose much stricter regulation. I’d like to trust that buying stock is investing in a company rather than feeling like the stock market is a school of small fish swimming with sharks who cheat as much as they believe they can get away with. If the focus was on dividends vs growth, I think we’d be better off. Maybe I am wrong but that’s how I see it.

I think of it like network security. Anything you do not explicitly disallow will be used, tried, and used in ways you probably didn’t think of. It isn’t a matter of expecting people to do the right (or legal) thing, most will but it’s a surety that some will not. That’s normal and why security is a process and systems have to adapt over time in response.

In the long term it works quite a bit better as a valuation tool. Bubbles tend to not last very long.

This is definitely realistic and not an over valuation based on AI-hype investor brain rot. Like, they’re a fucking graphics card company. Like, sure graphics cards can do some cool linear algebra, and linear algebra can do some cool things… but I’m sorry, they’re not going to be earning as much as Apple or Microsoft, companies that sell the whole rest of the computer to people and/or the plurality of software that runs on it.

Technically, they don’t even make the actual graphics cards, they just design them and then outsource manufacturing to TSMC.

But don’t you know that doesn’t matter, because by 2028 every singe company in the world is going to need a data center filled with tens of thousands of AI accelerators turning their own scrape of the internet into a chatbot, and so one of the companies that makes thouse accelerators is definitely going to have as much business as companies that make half of everyone’s phones or computer software./s

Designing graphic cards is really fucking hard though plus they make the firmware.

= AI bubble

Are they gonna pay them out? /s

Every employee could create their own companies and products. Opportunities and diversification!

Alternatively, each and every one of them can make 101 millionaires and still be a millionaire themselves!

Are they gonna pay them out? /s

Most Nvidia employees are paid in company stock. They have made millions in the last year.

AI is certainly a bubble but Nvidia has been working on this stuff long before the hype. I don’t think you can easily dismiss them. Personally I don’t think the future of AI is giant data centres, it will be running in desktops GPUs and dedicated AI chips. It already is.

It will be both. AI local and AI cloud.

For the average person every day use AI will be local on device. But companies with massive data sets will be processed with a data center.

Damn, those employees can buy they own yachts! Must be nice!

/s