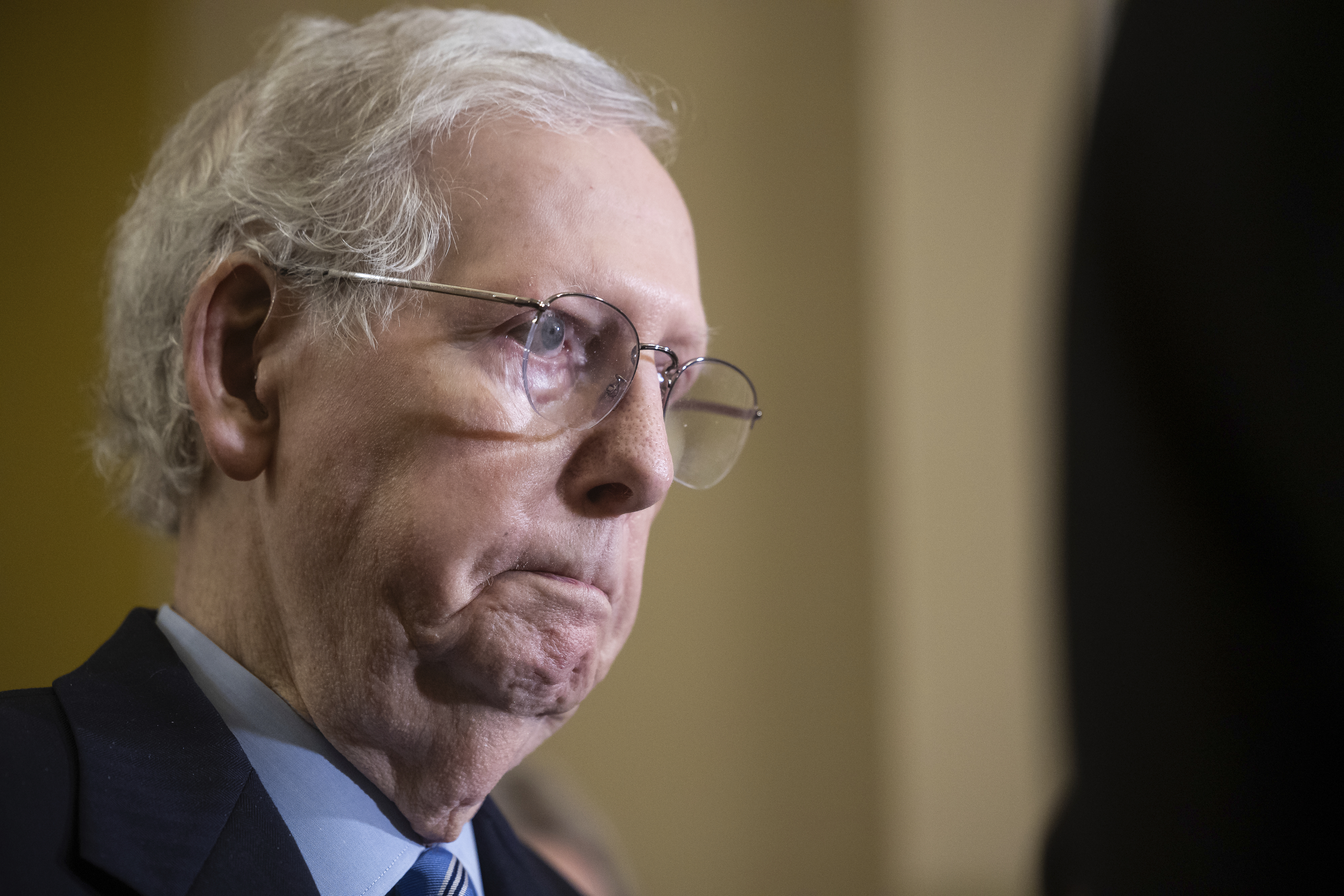

Highlights: Mitch McConnell and Senate Republicans worked for more than a year to make Joe Manchin’s retirement announcement on Thursday a reality. And for good reason: The Democrat’s decision puts Republicans on the precipice of a majority that’s eluded them for two straight election cycles.

McConnell himself laid the groundwork last fall when he flew out to see the popular Gov. Jim Justice (R-W.Va.), the GOP leader said in an interview. McConnell said Justice initially seemed like he had never considered it, but a few months later, Justice launched his bid.

“You can do the math. If we don’t lose any incumbent — and I don’t think we will — he’s No. 50. And one step closer to having a majority,” McConnell said of Justice. “I’ve been involved in a lot of recruiting over the years, some successfully, some not. But I think that’s the best recruiting job I ever did.”

deleted by creator

Yes, the stock market did so much better under Trump. There are many many reasons underlying the performance of the market under each of them.

For example most of the time trump was president was pre pandemic, but Biden was president through most of the pandemic. Trump was also president during the pandemic stimulus and enhanced unemployment payments, then Biden was president when all of that spending materialized into inflation which spooked the markets, and then caused interest rates to rise, prompting the tech layoffs

My 401k did considerably better under Trump. If that growth continued for 5-10 years I’d be able to retire quite early. But there are things that are much more important than a 401k.

(Saving for retirement is incredibly important if you haven’t started yet. Please. Please. Start now! The secret sauce is time. The younger you start the better off you’ll be - finger wagging PSA over)

Personally I’ve started three times!

Sadly retirement savings don’t last long when emergency expenditures keep knocking on the door.

I’m sorry to hear that. You definitely can’t save if you can’t eat. I hope your situation gets better soon.

Considering 401ks are generally based on rich people getting more money, I wouldn’t be surprised.

The stock market is one way the wealthy stay wealthy but that’s different than a 401k, which is different than a Roth IRA.

Well of course there’s differences, no one’s saying it’s exactly the same way in all forms and fashions. But that doesn’t mean they don’t have the same root, numbers on bar charts only ever going up and never coming down (which makes investors sad… and litigious). 401ks are a little more insulated from direct Stock Market transactions (depending on how you disperse it, of course), but that doesn’t mean they’re completely unaffected by it.